|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gap Auto Insurance Policy: Coverage GuideWhen you're cruising the streets of the United States, protecting your vehicle investment is paramount. A gap auto insurance policy provides peace of mind by covering the difference between what you owe on your vehicle and its actual cash value in the event of a total loss. This guide will help you understand the benefits, costs, and coverage of gap insurance. Understanding Gap InsuranceGap insurance is essential for U.S. consumers who have financed or leased their vehicles. It ensures that you won't be left paying out-of-pocket if your car is declared a total loss after an accident or theft. This type of insurance covers the 'gap' between your car's depreciated value and the remaining balance on your loan or lease. Benefits of Gap Insurance

Factors Affecting CostThe cost of a gap insurance quote can vary based on several factors, including:

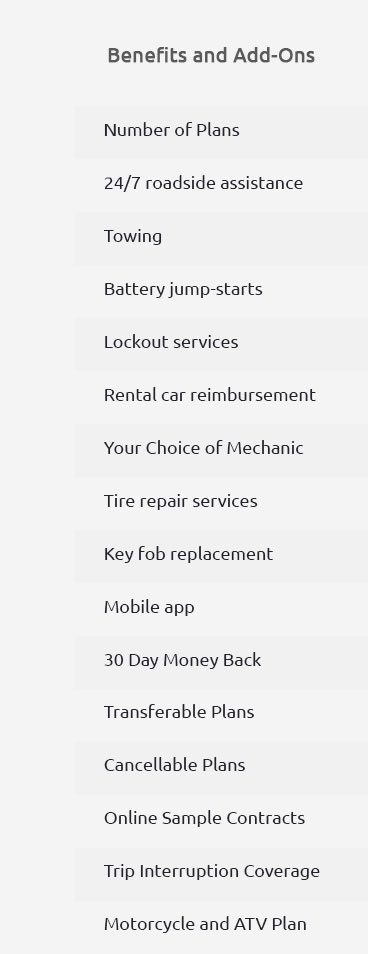

Is Gap Insurance Right for You?While gap insurance is not mandatory, it's a valuable consideration for anyone with a car loan or lease. It's particularly beneficial for vehicles that depreciate quickly or if you've made a small down payment. In places like Florida, where hurricanes pose a risk, gap insurance can be an invaluable safety net. Extended Auto WarrantiesBeyond gap insurance, car mechanical insurance or extended auto warranties offer additional peace of mind. These warranties cover repair costs that can arise from mechanical failures, ensuring your vehicle remains in top condition without unexpected expenses. What's Covered?Extended warranties typically cover:

Having both gap insurance and an extended warranty can provide comprehensive protection, allowing you to drive with confidence. FAQsWhat is a gap auto insurance policy?A gap auto insurance policy covers the difference between what you owe on your vehicle and its actual cash value in the event of a total loss, providing financial protection for U.S. vehicle owners. How do I know if I need gap insurance?If you've financed or leased a vehicle, especially one that depreciates quickly or if you made a small down payment, gap insurance can prevent significant financial loss in case of a total vehicle loss. Does gap insurance cover repairs?No, gap insurance only covers the financial gap after a total loss. For repair costs, consider an extended auto warranty or mechanical insurance. Understanding and investing in a gap auto insurance policy and extended warranties can offer significant benefits. Whether driving in bustling cities or serene suburbs, having the right coverage ensures you're prepared for whatever the road ahead may bring. https://www.libertymutual.com/vehicle/auto-insurance/coverage/gap-coverage

Gap insurance helps pay the difference between what's owed on a vehicle loan and the actual value of it, if it's stolen or a total loss. https://www.bankrate.com/insurance/car/gap-insurance-georgia/

Gap insurance in Georgia is used when something happens that renders your car a total loss. This could be in an accident, but could also be the case if your ... https://www.investopedia.com/terms/g/gapinsurance.asp

Key Takeaways - Gap insurance covers the difference between your vehicle's value and the amount you owe on your car loan or lease. - Gap insurance makes sense if ...

|